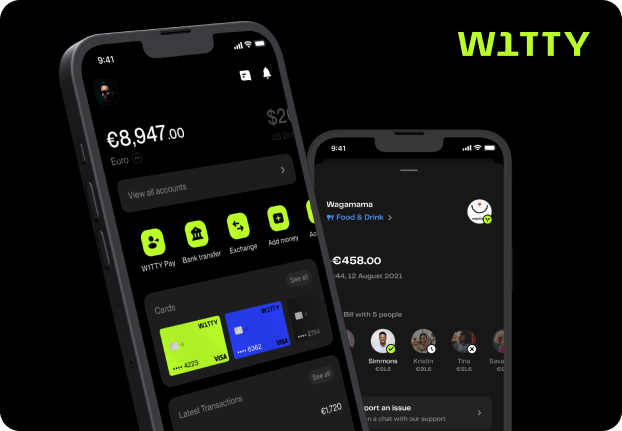

W1TTY: A secure digital wallet for the UK and Middle East with encrypted payments, multi-currency support, and insights

Project Overview

W1TTY is a advanced payment wallet for users in the UK and Middle East, offering quick transfers, secure payments, and financial insights for seamless money management with a focus on convenience and flexibility.

Problem Statement

Consumers in the UK and Middle East often struggle with fragmented and outdated payment systems that don’t meet their modern financial needs. Traditional systems are slow, lack flexibility, and fail to provide robust security measures. Users face difficulties with limited payment options, slow transaction times, and insufficient tools for financial management.

Key Findings

- Cross-Regional Needs: Users across the UK and Middle East faced challenges due to limited support for region-specific payment infrastructure and cross-border financial activity.

- Seamless Transactions: With the growing preference for cashless ecosystems, users sought a fast, efficient platform that handled both personal and business transactions without friction.

- Security Concerns: Users demanded strict data protection and regulatory compliance, especially given the sensitivity of financial transactions in diverse legal jurisdictions.

Implemented Solution

W1TTY was developed to address these challenges by offering a feature-rich, secure, and convenient payment wallet:

-

Quick and Secure Payments:

Developed a real-time payment engine with end-to-end encryption, allowing users to send and receive money instantly across borders while maintaining top-tier security.

-

Multi-Currency Support:

Enabled smooth cross-currency transactions with built-in exchange rate management—ideal for users navigating multiple financial systems.

-

Integrated Bill Payments:

Provided a consolidated hub for managing utilities, subscriptions, and recurring expenses, making daily financial management effortless.

-

Financial Insights:

Incorporated real-time analytics and budgeting tools that track spending habits and offer smart recommendations to help users stay financially aware.

-

User-Centric Design:

Designed a highly intuitive interface tailored for all user segments—from tech-savvy professionals to first-time digital wallet users.

-

Compliance and Trust:

Built with full adherence to local financial regulations (FCA and regional Middle Eastern frameworks), reinforcing platform credibility and legal security.

Results

W1TTY successfully modernised digital payments for its users by offering fast, secure transactions, real-time financial insights, and tailored money management tools. The platform’s robust security protocols and adherence to local financial regulations built user trust, while regional customisation and multi-currency support expanded its appeal. As a result, W1TTY improved user engagement, enhanced financial literacy, and established itself as a flexible and reliable solution for cross-border digital payments.