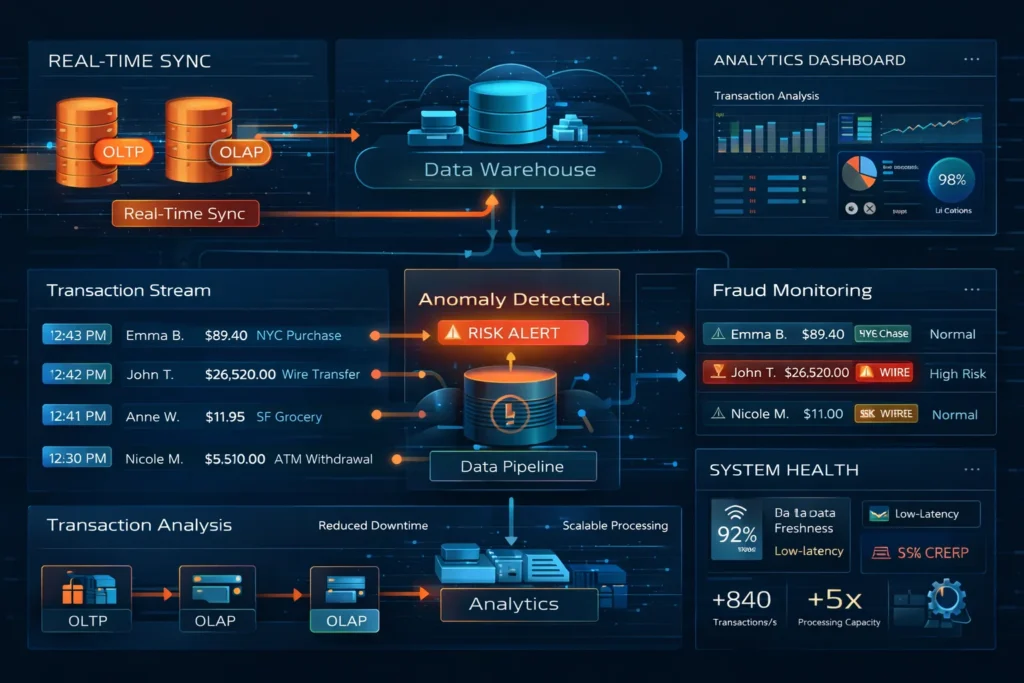

ETL Process Design: Real-time sync and fraud detection via an optimised data pipeline for instant insights and early risk alerts

Project Overview

This project focused on designing a robust ETL process to resolve data synchronization issues between OLTP (transactional) and OLAP (analytical) databases. The objective was to ensure real-time data consistency and empower early fraud detection by enabling efficient scanning of large-scale datasets. The new ETL architecture supported high-volume data flows while maintaining speed, reliability, and scalability for future use cases.

Problem Statement

The system struggled with over a days delay in syncing OLTP and OLAP databases, risking efficiency and fraud detection. A robust ETL process was essential for efficient scanning and timely fraud flagging.

Key Findings

- Synchronization Challenges: The existing infrastructure faced substantial delays in syncing transactional data with analytical systems, causing reporting lags and delayed business decisions.

- Fraud Prevention: Inconsistent data updates limited the organisation’s ability to identify fraud patterns in real time, creating risks in transaction-heavy environments like banking and e-commerce.

- ETL Optimization: The ETL processes were neither optimized nor standardized, leading to inefficiencies in data extraction, transformation, and loading—directly affecting data quality and reporting speed.

Implemented Solution

To address the synchronization issues and fraud detection challenges, the following solutions were implemented:

-

ETL Process Design:

Built a robust ETL framework tailored to support large-scale data flows. The pipeline ensured accurate extraction from OLTP systems, efficient transformation, and seamless loading into analytical platforms.

-

Synchronization Solution:

Deployed a synchronization solution to drastically reduce lag between transactional and reporting systems, improving the freshness and accuracy of business data.

-

ETL Benchmarking & Optimization:

Established performance benchmarks and best practices, resulting in a more reliable and efficient ETL process, suitable for high-volume, real-time environments.

-

Fraud Detection Reporting:

Introduced a custom reporting module to scan databases for unusual patterns—such as duplicate, high-frequency, or suspicious credit card transactions—flagging them for further investigation.

Results

The redesigned ETL pipeline reduced data sync time to near real-time, enabling timely and accurate data analysis. This improvement enhanced decision-making and operational responsiveness across departments. Fraud detection capabilities were notably strengthened, with approximately 65,432 suspicious credit card transactions flagged through the new system. Additionally, ETL and reporting performance improved by 76%, despite handling comprehensive scans across large datasets—setting a strong foundation for future data-driven initiatives and risk management strategies.